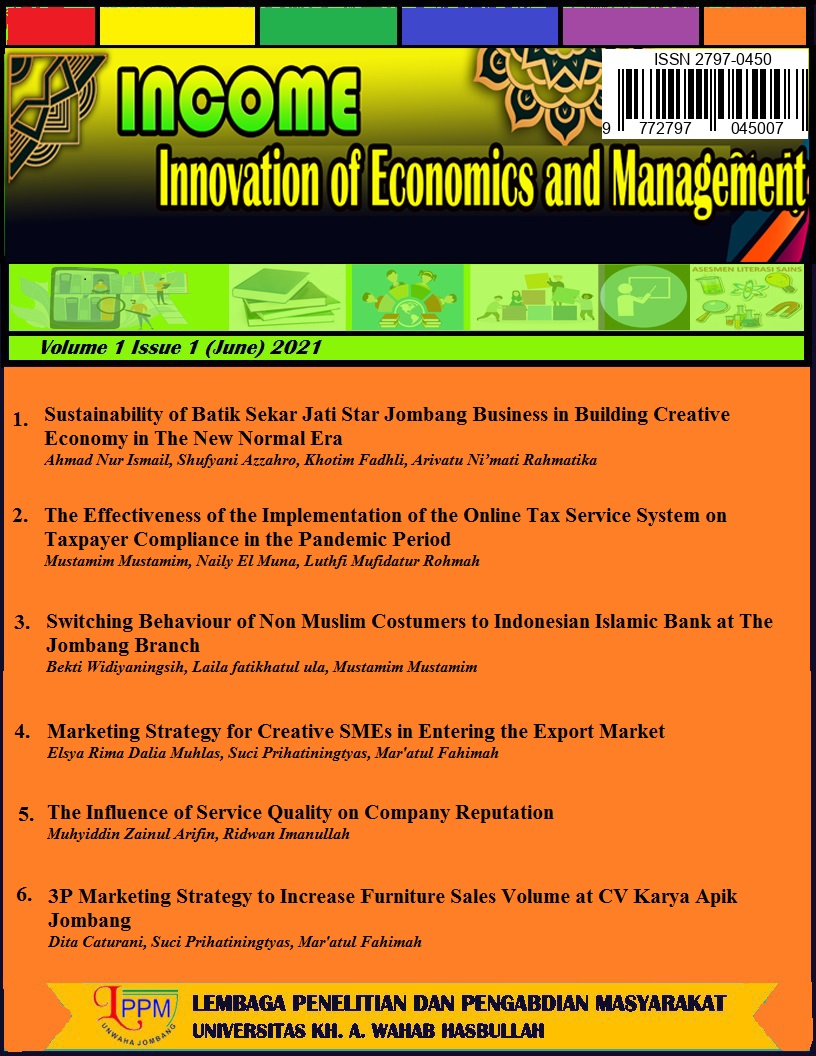

The Effectiveness of the Implementation of the Online Tax Service System on Taxpayer Compliance in the Pandemic Period

DOI:

https://doi.org/10.32764/income.v1i1.1531Keywords:

Effectiveness, E-System, TaxpayerAbstract

Tax is a mandatory contribution paid by each tax to the state and will be used for the benefit of the government and society. The purpose of the tax is to finance the nation, slow down the rate of inflation and develop economic conditions. This study aims to determine the effectiveness of implementing an online tax service system on taxpayer compliance during the pandemic. The method used in this study is a qualitative descriptive method. The results of this study are as follows: 1). The application of the online tax service system in terms of ease of use cannot be said to be effective; 2). The application of the online tax service system in terms of security and accuracy can be said to be effective, and 3). The application of the online tax service system in terms of time efficiency can be said to be effective.